With 2026 marking 20 years for Zero Motorcycles, the Director of International Expansion for the region Adrian O’Donoughue talks strategy, realities and the road ahead in Australia.

Electric bikes have never had an easy run in Australia and Zero knows that better than most. As the brand approaches its 20th year in 2026, its Australian reset is being shaped by Adrian O’Donoughue, Zero’s Director of International Expansion for the Asia-Pacific region.

Zero Motorcycles is back in Australia again, and the challenges haven’t changed. Electric motorcycles are still harder to sell than electric cars, particularly in a market like ours. But as the company marks its 20th year in 2026, what has changed is the approach.

For Adrian O’Donoughue, Zero Motorcycles’ Director of International Expansion for the Asia-Pacific region, that reality has framed the past three years of work. Two-wheeled EVs haven’t benefited from the tailwinds that have helped electric cars into the mainstream. There have been few incentives, little infrastructure built with motorcycles in mind and none of the social reinforcement that comes from seeing EVs everywhere in daily life. Add Australia’s distances, touring habits and expectations around both range and refuelling time, and the gap between curiosity and commitment remains wide.

“We knew that it was always going to take time to build a brand, to get people interested in electric,” O’Donoughue says. “Price was one, people still getting their head around charging and range were always there, same as with cars.”

After more than two decades with Harley-Davidson, including senior regional roles based in Singapore, he understands what a fully mature motorcycle brand looks like. His role with Zero Motorcycles has been very different, focused less on growth targets and more on putting workable structures in place across markets that are still finding their footing.

That focus on structure over scale is reflected in how Zero operates locally. There is no standalone Australian office and no dedicated local team; O’Donoughue himself is the company’s sole presence on the ground, working remotely as the link between regional markets and Zero Motorcycles’ global headquarters in the Netherlands where it has relocated from California.

“Just me, working from home. It’s always been like that,” he says. His role centres on appointing and supporting distributors across the Asia-Pacific region, leaving them responsible for everything from import logistics and warehousing through to dealer development, sales and aftersales. And the latest and only distributor for the brand is Zero-dealer-turned-importer Australian Electric Motor Co., following the collapse of Peter Stevens Motorcycles, who were the previous importers and distributors.

O’Donoughue himself is the company’s sole presence on the ground, working remotely as the link between regional markets and Zero Motorcycles’ global headquarters…

The American brand’s persistence is underpinned by a longer track record than perhaps many realise. Zero Motorcycles was founded in 2006 by former NASA engineer Neal Saiki, and from the outset pursued electric motorcycles as a primary focus rather than a side project.

That intent became tangible in 2009 with the arrival of the Zero S, widely regarded as the first serious production electric motorcycle (the second after Vectrix’s failed maxi-scooter). It was a lightweight, short-range machine built around necessary compromises such as skinny tyres and a modest top speed. What followed though was steady, visible development as range, performance and scale improved year-on-year.

Financial backing played a critical role. In 2011, private equity firm Invus injected an initial US$17 million into the business, with a further US$9 million contingent on growth targets being met. The relationship deepened again in 2019, when Invus committed a US$250 million investment spread over 10 years, giving Zero the financial runway to continue developing its own componentry and platforms rather than relying on external suppliers.

“When Invus committed a US$250 million investment spread over 10 years, it gave Zero the financial runway to develop its own componentry rather than relying on external suppliers”

By the time the SR/F arrived in 2018, the bike effectively reset expectations for electric motorcycles, moving away from the lightweight commuter focus that had defined earlier EV bikes. For the first time, Zero was producing a full-size, performance-focused roadbike that could be judged alongside premium internal-combustion rivals on its own terms.

“We have seen lots of brands come and go, but none of them have been really as well-established or as well-funded,” O’Donoughue says. “Zero has stood the test of time for a couple of reasons – one is we’ve got really long-term committed investors, not just venture capitalists, but we also sell motors and batteries and stuff to Polaris.”

In recent years it has expanded its California production facility to bring battery and motor manufacturing in-house, while also making the strategic decision to relocate its global headquarters from the US to Europe. The move reflects where electric bikes currently enjoy stronger policy support and market momentum, while its engineering and development roots remain on the US West Coast.

That longevity has come at a cost. In the premium electric motorcycle space, Zero has spent much of its existence operating without the safety net that benefits electric cars or even lower-cost two-wheelers. There has been no mass category push, no cluster of brands reinforcing the message and no shared momentum to normalise the technology.

We’re kind of a pioneer really here because no one else is doing it, at least not in the premium space, Which makes it harder because if you’ve got all the manufacturers like you do in cars all pushing and marketing and talking about electric, there’s a momentum, there’s a mass push, which we don’t have in motorcycling unfortunately, so we’re the lone wolf for now.

That isolation helps explain why progress in markets like Australia has been uneven. Without competitors helping to shoulder the burden of education, infrastructure and perception, Zero’s local fortunes have often hinged on individual partnerships rather than category-wide momentum — a reality that has shaped each of its Australian chapters.

Zero’s history in Australia hasn’t been without its hurdles. The brand first appeared locally in the early 2010s, then again several years later, before the most recent distributor arrangement with Peter Stevens brought electric motorcycles back into mainstream dealership networks. Each attempt arrived with genuine intent, but also ran into the same underlying realities around pricing, perception and scale.

“Without competitors helping to shoulder the burden of education, infrastructure and perception, Zero’s local fortunes have often hinged on individual partnerships rather than category-wide momentum”

“Despite what happened, [Peter Stevens] invested quite a lot of money and time and people and dedication,” O’Donoughue says. “It’s a shame it didn’t have more time to pan out, because I think it would have worked out very differently.”

The collapse of Peter Stevens in May 2025 created the biggest and most public disruption. Hundreds of Zero motorcycles were sold at auction, flooding the market in a way no manufacturer would choose, and inevitably softening short-term demand for new bikes.

“It’s not an ideal situation from a number of angles. But the positive side is 420-odd people signed up and bought bikes, and they paid pretty good money for them,” he says. “So there’s definitely interest in electric, and it proved there’s interest in Zero.” But according to O’Donoughue, the immediate concern was responsibility. Riders who had bought at auction were still Zero customers and the brand’s credibility locally depended on how they were treated regardless of their entry point.

“The collapse of Peter Stevens in May 2025 created the biggest and most public disruption”…

“The most important thing was servicing all the customers that not only bought pre-auction, but post,” O’Donoughue says. “So we’ve got good service points now set up in most of the capital cities and making sure that those guys get what they need.”

That service-first way of thinking has shaped the current approach. Rather than rushing back to market with a full model range and fresh promises, the priority has been rebuilding support infrastructure, parts supply and technical capability across the major population centres.

Only once that foundation is stable does it make sense to talk seriously about new models, pricing and growth. “We’ve been very conscious of not trying to do too much too quickly, you need to make sure the basics are right.”

The brand is now in the hands of Gold Coast-based Australian Electric Motor Co, which was appointed as Zero’s Australian distributor following the collapse of Peter Stevens. Rather than attempting a rapid relaunch, the focus has been on stabilising the ownership experience for existing riders, particularly those who bought bikes at auction and were left without a clear support network.

Check out our Zero SR/F review here… and our DSR/X review here…

Australian Electric Motor Co. operates through its Grid Motorcycles retail arm and brings prior experience dealing exclusively in electric two-wheelers. That background has shaped the current rollout, with service coverage prioritised ahead of new bike sales. Service agents are now in place across most major population centres, covering Brisbane, the Gold Coast, Sydney, Canberra, Melbourne and Adelaide, with Perth identified as the remaining gap.

The appointment reflects a shift away from scale-first ambitions and towards alignment with a partner that understands both the limitations and the opportunities of the electric motorcycle market. With support structures largely rebuilt, attention can now begin to turn to product planning, model availability and what a sustainable Australian presence actually looks like in the medium term.

And while the available line-up for 2026 is still yet to be confirmed, O’Donoughue did rule out the firm opting for a direct-to-customer sales model, despite its growing adoption among electric car brands and some electric motorcycle start-ups. While he did admit that direct online sales are now being trialled by Zero in some overseas markets, particularly in Europe and the US, he says the realities of selling motorcycles – particularly road-registered one – remain fundamentally different.

“It’s something that they’ve looked at in the US and Europe,” he says. “I think that the concept is that it’s much easier with off-road vehicles, because there’s not as many regulations and requirements.” In those cases, a bike can be delivered partially assembled, with minimal compliance hurdles. Roadbikes introduce additional layers of complexity, all of which still favour a dealer-based model. There’s also the cultural difference between two wheel and four. And where the model becomes even harder to justify, he says, is at the premium end of the market.

“Bike riders, I think, tend to be a bit more emotional and particular about their products,” he says. “So they often want to go to a dealer and have that interaction, have the confidence in someone. For the bigger bikes, people are investing quite a lot of money. As you get up into the higher ranges, there’s still experience to consider and there’s quite a bit of technology there that needs to be walked through with the customer and understood.”

While much of the past three years has been about stabilisation, support and choosing the right markets, Zero’s future isn’t being defined solely by where it sells bikes. Just as important is what it continues to build, and how deliberately it goes about doing it. Ongoing product development is needs to be sustainable for a relatively small manufacturer operating in a demanding space.

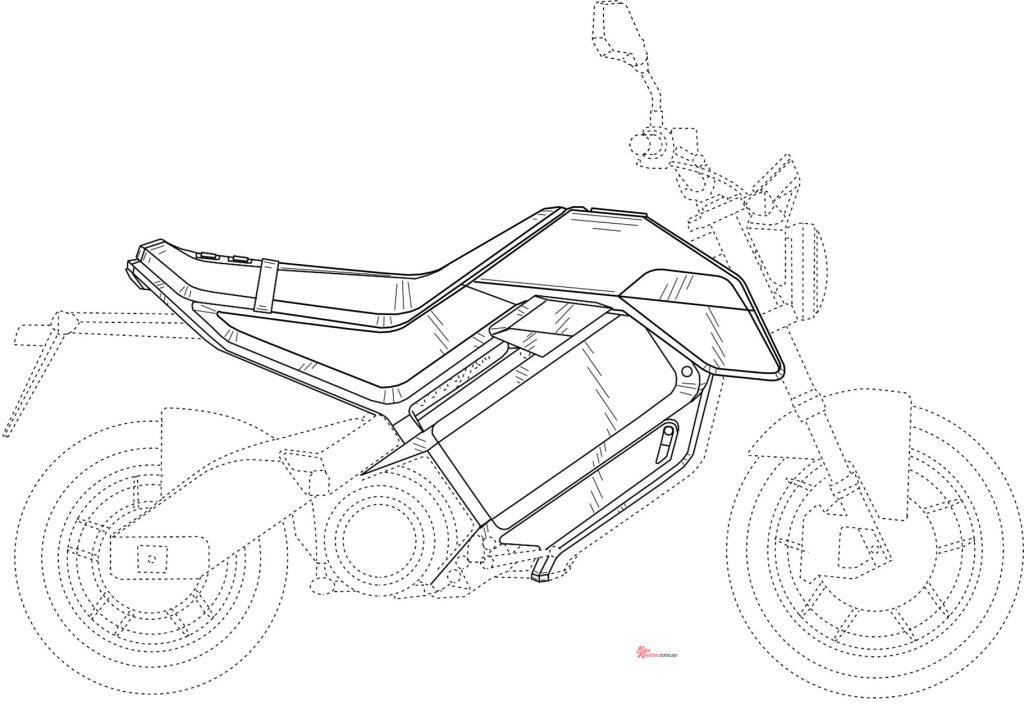

“I think they’re doing as much as they possibly can and doing a lot for the size of the company, definitely,” he says. “At the end of the day, they are a relatively small organisation, punching above their weight in a tough category.” Alongside Zero’s existing road and dual-sport platforms, the firm has signalled interest in new segments, including a two-tiered off-road model called X-Line, an urban-focused scooter called the LS1 and a Grom-sized concept (pictured above).

“The firm has signalled interest in new segments, including the X-Line – an urban-focused scooter and a Grom-sized concept”

“And they teased another concept at EICMA last year as well, which details are still unknown. But the good thing is that there’s investment in new products continuing, not just what we have on the table now.” While the temptation to broaden the range quickly is obvious, O’Donoughue believes restraint is essential. “So could they be doing more? Sure, anybody could do more,” he says. “But for the scale of the company, the resources, you don’t want to go too far too soon. Otherwise you spread yourself thin and you can’t do anything well.”

In a market where many electric motorcycle brands have appeared briefly and disappeared just as quickly, Zero’s continued presence – and its willingness to again rebuild – may be the clearest indication of how seriously it views the long game.